How the world’s biggest companies are quietly relocating their global headquarters to pay almost nothing in corporate tax — and why it’s perfectly legal.

Welcome, curious capitalist. While governments scramble to close loopholes and raise revenue, the smartest multinationals are doing something far simpler: they’re packing up their brass plaques and moving the entire headquarters to a friendlier postcode. Not for the beaches or the skyline — for the tax rate. From sleepy European islands to gleaming Gulf metropolises, a new wave of corporate migration is underway. And it’s accelerating faster than ever in 2025.

Let’s follow the money.

Polymarket just launched Earnings Markets — the cleanest way to trade corporate results without betting on the stock price itself.

Yes/No contracts on the exact outcomes that move billions:

• Will TSLA deliver more or less than X vehicles?

• Will META beat or miss on ad revenue?

• Will AMD actually mention “MI400” on the call?

Settle your view in hours, not days. No gamma, no delta, just pure conviction.

See every live earnings market at Polymarket →

1. The Great Corporate Exodus: Headquarters Are the New Offshore Account

In 2025, “headquarters” is less about a fancy building and more about a brass plate in the right jurisdiction. Moving the legal domicile used to be a nuclear option. Today it’s routine — and the savings can run into tens of billions. The hottest passports for a multinational right now?

- Ireland – still the undisputed champion at 12.5% (15% for very large firms under the global minimum tax, but loopholes abound).

- Switzerland – canton shopping can get you down to an effective ~11-14%, plus banking secrecy that never really died.

- Singapore – 17% headline, but effective rates routinely below 5% with the right incentives.

- United Arab Emirates – federal 9% corporate tax since 2023, but mainland vs. free-zone games + 0% personal income tax make it irresistible.

- Cayman Islands / Bermuda / BVI – zero corporate tax, increasingly accepted even for operating HQs of mining and energy giants.

Real-world scoreboard (2023-2025 moves):

- Binance → Dubai (completed)

- Parallel (crypto) → Cayman

- Marc Lore’s Wonder Group → UAE

- Hedge fund juggernauts (Citadel, Millennium satellite offices) → Dubai & Singapore

- Multiple Fortune-500 industrial firms quietly redomiciling holding companies to Bermuda

2. Ireland Refuses to Surrender the Crown

Even after the OECD 15% global minimum tax and the death of the infamous Double Irish with Dutch Sandwich, Dublin is still printing money. Why? Because the new tricks are even better than the old ones.

- Knowledge Development Box: 6.25% effective rate on certain IP income.

- A flood of Section 110 SPVs and ICAVs that still let U.S. firms “check the box” into zero tax on certain flows.

- The government literally markets “We’re still 12.5% — and we speak English.”

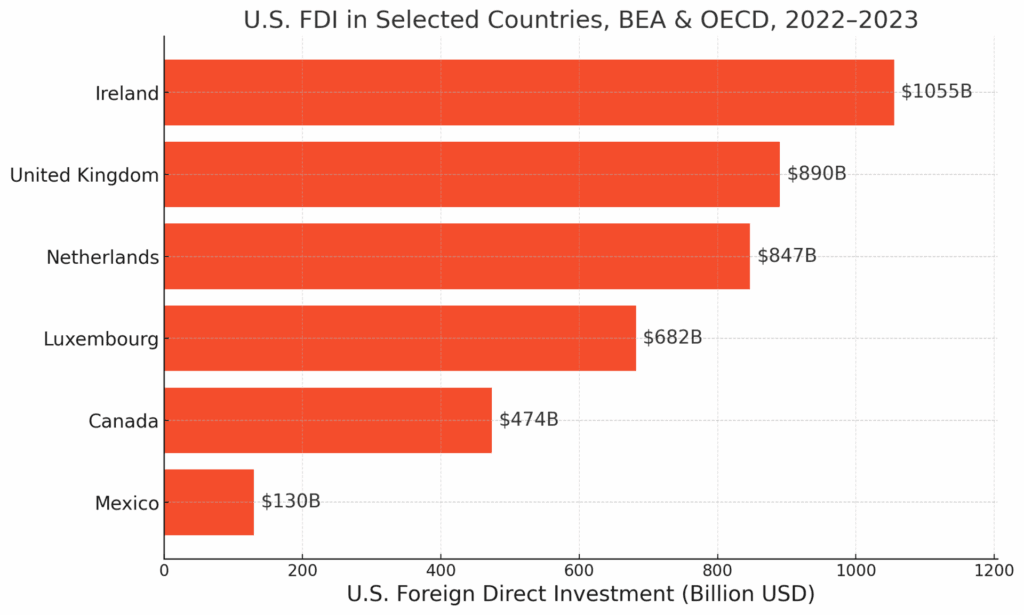

Result: Ireland took in €27 billion in corporate tax in 2024 — more than double pre-pandemic levels — almost entirely from ten U.S. multinationals. The country is now running one of the largest budget surpluses in Europe while simultaneously being the world’s biggest tax haven in disguise

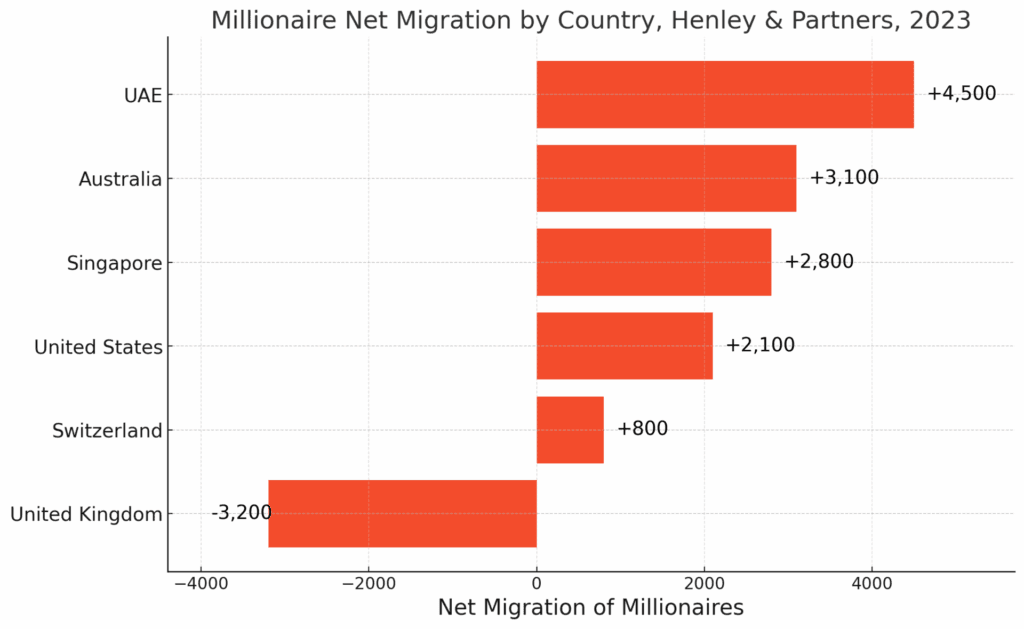

3. Dubai & Abu Dhabi: The New Zero-Tax Powerhouse

The UAE used to be where you parked personal wealth. Now it’s where you park the entire company.

- 9% federal tax only applies to mainland companies above AED 375k profit; free-zone entities doing purely international business → still 0%.

- Golden Visa + remote employee sponsorship means your engineers can live there too and pay 0% personal tax.

- No forex controls, common-law courts in DIFC/ADGM, and a timezone that overlaps both Wall Street and Asia.

Recent arrivals that made headlines (and many more that didn’t):

- Parallel (formerly Eiger) – full HQ to Cayman, but executive team now tax-resident in Dubai

- Tether reportedly shifting treasury and corporate functions

- At least a dozen billionaire family offices are redomiciling their operating companies entirely

Quiet trend: European founders who raised in USD are now flipping their holding companies to UAE entities before IPO to permanently escape EU exit taxes.

4. The Real Winners and Losers

Winners:

- Small nations that turned geography + clever lawyering into GDP rocket fuel

- Shareholders who get an instant 5-15% boost to after-tax earnings

- High-IQ knowledge workers who can now live in 0% tax jurisdictions without giving up urban life

Losers:

- High-tax Western governments watching their corporate base evaporate

- Ordinary citizens who end up shouldering more of the load when Starbucks or Google pays less than the local coffee shop

This isn’t going away. The OECD can set a 15% floor all they want — when Ireland, Singapore, and the UAE all happily sit just above it while handing out grants that drop the effective rate far lower, the game continues. The age of the nomadic megacorp is just getting started.

P.S. If you think you know which company quietly flips its domicile next — or whether the EU ever collects that €13 billion from Apple — there’s now a liquid market for that conviction too.

Leave a Reply